Graph Writing # 98 - Changes in average house prices in five different cities

- Details

- Last Updated: Monday, 28 July 2025 19:55

- Written by IELTS Mentor

- Hits: 280347

IELTS Academic Writing Task 1/ Graph Writing - Column Graph:

» You should spend about 20 minutes on this task.

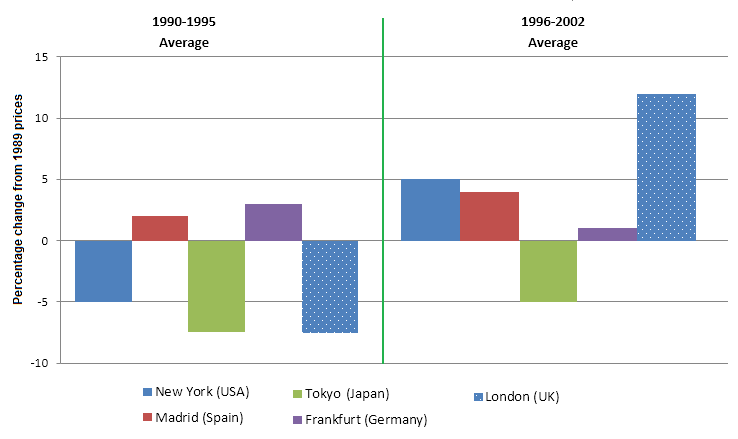

The chart below shows information about changes in average house prices in five different cities between 1990 and 2002 compared with the average house prices in 1989.

Summarise the information by selecting and reporting the main features, and make comparisons where relevant.

» Write at least 150 words.

Percentage change in average house prices in five different cities

1990 - 2002 compared with 1989.

Sample Answer 1:

The bar chart shows data on the changes in the prices of houses in two spans of periods, 1990 – 1995 and 1996 – 2002 compared to the prices of 1989. As is presented in the bar graph, prices of the house got down in New York, Tokyo and London during 1990 to 1995 while the prices increased in London & New York during 1996 to 2002 compared to the prices of those houses in 1989.

According to the bar graph, the prices of houses in Madrid and Frankfurt increased by 2-3% during 1990 – 1995 while the prices decreased in New York, Tokyo and London by 5 to 8% in the same period compared to the prices of those houses in 1989.

Interestingly during the period 1996 to 2002, the prices in all cities except Frankfurt increased. Price increases of housing were 5% in New York, 4% Madrid, and over 11% in London compared to their prices in 1989. The only city where the prices decreased in 1996 to 2002 compared to the previous 5 years was Frankfurt.

Sample Answer 2:

The bar chart depicts the average house prices in five different cities between 1990 and 2002 compared with the prices of the year 1989, a period of 12 years. Overall, it can be seen that the average house prices in London were shown fluctuating throughout the year.

In details, the percentage of house prices in New York in between the year 1990 -1995 was accounted just 5 percent in a negative direction. However, the same percentage in New York was on the positive side between 1996 - 2002. Similarly, the average house prices in London and Tokyo (Japan) was presented in similar percentage approximately 7 percent in negative in 1990-1995 where the percentage of London peaks at the highest position at 13 percent in 1996-2002 and Tokyo city house price was still observed the on the negative side at 5 percent.

The percentage change in average house price of Madrid (Spain) was only 1 percent in previous 6 years but it dramatically increased 4 times in next following year. In 1990-1995 the average house price of Frankfurt (Germany) was only 2 percent but it was interesting that it declines and reached the same percentage as Madrid (Spain) at 1 percent.

[ Written by - Labin Sapkota ]

Sample Answer 3:

The diagram illustrates the mean variation in the price of a house in five various cities when compared with that in 1989 in a period of 12 years from the year 1990. Overall, it is clearly shown that majority of these five cities had their house prices lower from 1990 to 1995 than that in the year 1989 whereas all cities showed an upward trend in the average house prices between the years 1996 and 2002 except Frankfurt.

First and foremost, the house prices in Tokyo were lower than that in the year 1989 throughout the given period. However, there was a rise in the house prices from 1996 to 2002 than from 1990 to 1995 (-5% and approximately -7% respectively) which was comparatively lower than that in 1989. Furthermore, every city had its house prices rising over the period except Frankfurt in Germany which showed a slight drop of about 1%.

Interestingly, London was the city that had the largest variation in house prices among the five cities from 1990 to 2002 in comparison with that in 1989 (around 19% in total). There was a bigger fluctuation in house prices in New York than in Madrid in Spain (10% and nearly 5% correspondingly).

[ Written by - Lee Wing Qeen ]

Model Answer 4:

The bar chart demonstrates what changes five major cities experienced in average house prices in the span of periods: 1990-1995 and 1996-2002, compared with the average home value of 1989. Overall, house buying costs went down considerably in New York, Tokyo and London between the period of 1990-1996 while it augmented dramatically in London with a gradual increase in New York and Madrid cities during 1996-2002.

A closer look at the graph reveals the fact that average houses purchasing price during 1900-1995 in Tokyo and London decreased by approximately 7% compared with the average price in 1989. However, during the same period, Madrid and Frankfurt experienced a property price rise by about 1% and 1.5% respectively.

Looking at the figures between 1996-2002, average house price in London went up dramatically, almost 12%, the largest property price hike. Meanwhile, property prices upsurged by 5%, just below 5% and around 1% consecutively in New York, Madrid and Frankfurt. Interestingly, only London went through 5% decline in average price of houses over the same period of time.

[By - Jiban]

A quick look at the data suggests that there were dramatic changes in real estate prices in London and New York while a steady increase can be seen regarding the price in Madrid.

In detail, property price in the Spanish capital between 1990 and 1995 was 2% higher than that in 1989. Housing cost in Frankfurt also rose, by 3%, while this figure in New York dipped by five per cent. However, house price in the latter city surged remarkably and throughout 12 years, it increased by exactly one-tenth overall. Additionally, the average figure from 1996 and 2002 in Madrid represented a 4% increase from its statistic in 1989, approximately 8 times that in Frankfurt.

As for the capital city of Japan, house price was lower throughout both of the given periods. Compared with the year 1989, it was 7% less between 1990 and 1995, and then rose slightly by 2%. The cost of housing in London was initially also about 7% lower but afterwards, it skyrocketed and represented a rise of more than 10 per cent from 1996 to 2002.

Generally speaking, real estate prices in those cities showed varying trends while the price increased highest in London and New York.

To begin with the period from 1990 to 1995, property values in New York was 5% less than its value in 1989, while Tokyo and London showed similar figures around 7% less than in 1989. However, Madrid and Frankfurt were almost 3% and 4% higher respectively.

Moving on to the period from 1996 to 2002, the figures changed in New York when it jumped to 5% higher than in 1989, which is twice as much as its value in the first half. The prices in Madrid remained on the positive side of the graph with a minimum rise to nearly 4%. While real estate prices slipped in Frankfurt to around 1% higher than 1989, Tokyo kept its prices on the negative side of the graph with 5% lower prices. When it comes to London, the figures dramatically soared up to more than 12% higher than in 1989, which is almost treble than the price of the first half of the measurement period.

Overall, it can be seen that the residential price in New York experienced the highest change, and oppositely, Tokyo accounted for the least variance of the house price.

During 1990-1995, London and Tokyo witnessed almost 8% price decrease in housing compared to the price in 1989. In addition to that, New York experienced a decline in property prices by -5%. Meanwhile, Madrid and Frankfort witnessed a price rise by about 2-3%.

During the second period (1996-2002), all cities except Tokyo saw a fall in their housing price compared to the price in 1989. The change rate for New York totally reverted from -5% to 5%. Also, the biggest change was recorded for London (over 10%). Property price in London increased from approximately -8% to over 10%. Tokyo, Frankfurt and Madrid were the cities with insignificant changes in price changes which recorded around 3% price change.

Overall, we can see that the average housing price in most cities fell between 1990 and 1995, but most of them increased between 1996 and 2002.

London experienced by far the greatest change in house prices over the 13-year period. Over the 6 years period, after 1989, while, the cost of average homes in both Tokyo and London dropped significantly by around 7%, New York house prices sank by 2%. In contrast, marginal decrement can be seen in the average housing price in Madrid and Frankfurt, 2% and 3% drop respectively.

Between 1996 and 2002, the housing price in London soared to around 12% above the 1989's average. Similarly, average housing in New York became 5% more expensive than they were in 1989, but they still remained 5% cheaper in Tokyo. Although the cost of an average home in Madrid declined by a further 3% from the average price in between 1990 and 1995, prices in Frankfurt had a nominal decline of 1%.

In general, the period 1996-2002 proved to be more fruitful for the housing industry as overall prices grew in contrast to that of 1990-1995. During this period, the house price of London boomed notoriously.

The house prices in Madrid and Frankfurt during 1990-1995 increased by less than 3% as compared to that of 1989. Apartments in New York were sold at a declining price, by 5% and Tokyo and London by 7.5%. On the contrast, the house prices were on the rise between 1996-2002, with London skyrocketing to almost 12% positive rise followed by New York, 5%. Madrid did slightly better while Tokyo's real estate business was down by 5% but better when compared to 1990-1995. Frankfurt was the only city to face the decline in the housing price as compared to 1990-1995 with only a 1% increase from an average of 1989.

Overall, the average prices had dramatically dropped especially in the USA, Japan, and the UK over five years compared with that in 1989 while in most cities the index recorded a growth in the last 6 years.

It is clear that during five years, the average prices were evidently lower, especially in New York, Tokyo and London -5%, -7.5%, -7.5% respectively whereas compared in 1989 the prices were a little high in Madrid and Frankfurt approximately just under 2.5%. Unlike house prices that were lower, prices in the house slightly increased since 1996 in different countries. Demand for houses caused dramatically increased especially in New York, Madrid, London correspondingly about 5%, 4% and 12%. On the other hand, the prices of houses in Germany were just under 2.5% between 1990 and 1995, the index sharply moved upward just above 3% from 1996 to 2002.

Overall, between 1990 and 1995, the house prices in these cities decreased. House prices in New York declined by about 5% while in Tokyo and London the price went down by roughly 7.5% compared with the price in 1989. House prices in Madrid and Frankfurt were slightly higher than the previous year with approximately 2% increase. Five years later, the most dramatic price change happened in London which hit approximately 12% increase. The soar in house prices also occurred in New York, Madrid and Frankfurt with approximately 5%, 4% and 2% increase respectively. Although Frankfurt’s housing price was lower compared with 1990-1995's price, the price remained almost stable with about a 2% increase in 12 years. On the contrary, Tokyo's housing costs were higher than the average last half-decade but it still fell compared with 1989 by precisely 5%.

Report